Selected Financials

Highlights of 2022/23

The Financial Picture

To illustrate WinSport’s financial situation and the scope and scale of our operations, we present selected highlights from our annual audited financial statements.

WinSport follows the fund method of accounting and divides the full scope of operations into three separate funds, depending on the nature of each transaction. The Operating Fund includes the assets and liabilities (excluding property, plant, and equipment) related to the operations of the organization. The Restricted Fund includes the assets and liabilities of government capital and business operations, other restricted funds with specific purposes, and all property, plant and equipment of Canada Olympic Park, the Bill Warren Training Centre in Canmore, and the Beckie Scott High Performance Training Centre on Haig Glacier. The Endowment Fund includes the assets and liabilities of the Olympic Endowment Fund (“OEF”), the Oval Capital Reserve Fund and the OCO Trust Fund (OCO stands for Olympiques Calgary Olympics, which was the ’88 Olympic Organizing Committee).

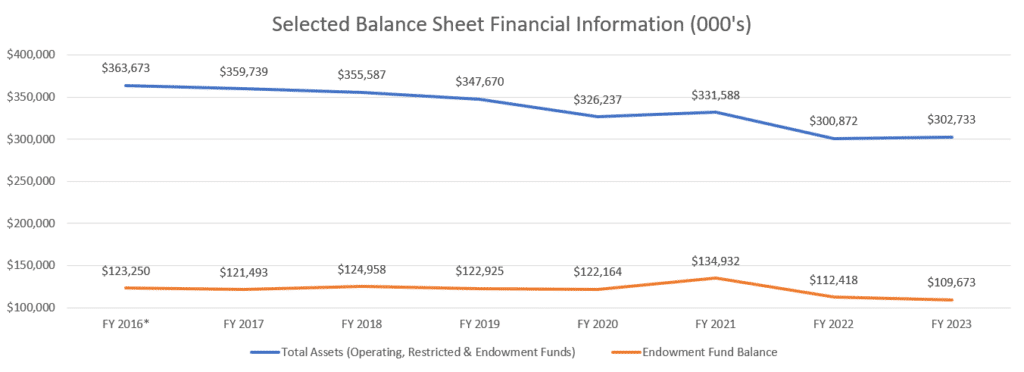

WinSport’s total assets are the sum of the Operating Fund assets, the Restricted Fund Assets, and the Endowment Fund assets. For example, in Fiscal Year 2023, the total assets of those three funds were $16M, $177M, and $110M respectively ($303M total).

Without a significant recapitalization, we expect total assets to decline over time as our physical buildings and equipment are depreciated through use. We have taken steps forward with the announcements in August and September 2022 that we are proceeding with a renovation of the 35-year-old day lodge thanks to funding commitments from the Government of Canada and Government of Alberta; however, additional recapitalization of COP and the Endowment Fund is still required.

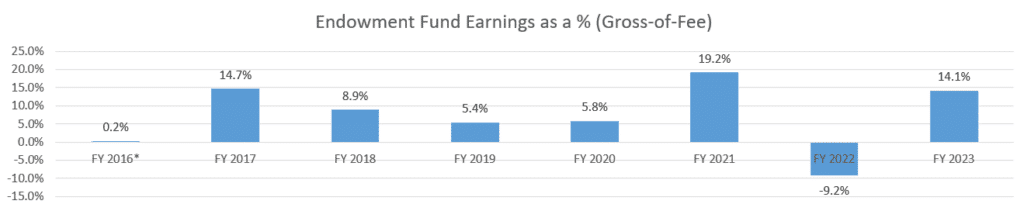

The Endowment Fund balance has held reasonably steady pre-covid, but after a strong 2021, 2022 experienced a significant downturn in the broad investment markets, and the Endowment fund experienced a negative return before rebounding strongly in FY2023. Despite the strong returns in FY2023 the fund balance remained steady at approximately $110M due to cash draws post-COVID.

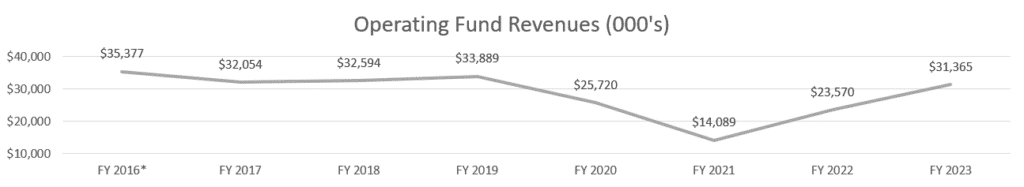

We have been working over the past decade to diversify WinSport’s revenue-generating business as we strive to increase cash flow and reduce the annual Operating Fund loss. Since 2010, WinSport has more than doubled Operating Fund revenue through successful diversification and optimization of our operations. While the global COVID-19 pandemic devastated WinSport’s operating revenues for more than two years, it forced us to simplify operations and reduce the scale and scope of services we offer to our stakeholders and guests. Fiscal 2022 and 2023 have seen a broad rebound in economic activity, but there are several areas of our business that have been slower to recover, namely food and beverage and corporate events (such as holiday parties, etc.) due to the long event bookings lead-time.

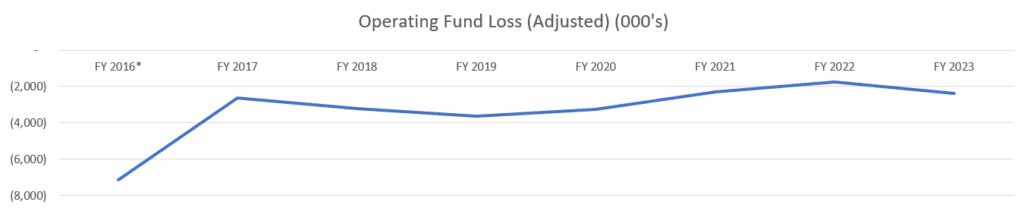

As shown in Chart 3, (note the negative scale), we have been successful in recent years in reducing WinSport’s annual operating loss by expanding revenue-generating lines of business and running lean operations. By February 2020, WinSport was on track for its best financial performance of many years. Then the pandemic hit, cratering revenue and adding new costs. Although Chart 3 indicates WinSport managed our negative cash flows effectively during the pandemic, the scale and scope of our operations was materially reduced during the period. During Fiscal 2023 the overall operating loss did increase marginally, but as per Chart 2, that was in the context of significantly increased operational scale and scope.

The WinSport Operating Fund has recorded an annual operating loss every single year since 1989. WinSport was never intended to be a money-making enterprise and WinSport has survived for the past 34 years because the annual operating losses have historically been covered by the Endowment Fund earnings. However, we do not expect the earnings from the Endowment Fund to cover our ongoing operating loss in the future.

The Operating Fund loss presented above has been adjusted (by removing the non-cash depreciation, investment earning, and grants made to the Calgary Olympic Oval) to represent each year’s loss from operations more clearly.

Notwithstanding the significant downturn in the equity markets over FY2022, the investment portfolio rebounded nicely in Fiscal 2023. Fiscal 2024 is continuing this trend towards strength and future annual returns are modeled to be in the 4-5% range, on average, beginning in fiscal 2025 based on the Endowment Fund’s diversified investment portfolio asset mix, which includes some alternative investments such as Canadian real estate that have held up well during this time of turbulence.

Conclusion

WinSport has weathered the pandemic better than we imagined during the pandemic, but the financial challenges ahead are daunting. WinSport is focused on fulfilling our mandate with all available resources while also prudently managing our reserves so we can continue to deliver value to Calgarians, Albertans, and Canadians for the Next 30+ years.